Biggest source of tax revenue in every state

Biggest source of tax revenue in every state

“Taxes are what we pay for a civilized society,” said Oliver Wendell Holmes, a justice on the United States Supreme Court from 1902 to 1932.

Indeed, money collected in taxes educates children, cares for the sick, paves the country’s roads, and shelters the poor.

To navigate the tax landscape in every state, Stacker used survey data from Pew Charitable Trusts, which analyzed tax revenue for U.S. states for the 2019 financial year. For each state, it found the biggest source of tax revenue from the following categories: personal income, corporate, general sales, selective sales, severance, licenses, and property. The data was released in June 2020.

The 50 states have carved out their own ways to collect taxes from their residents and businesses. Those states rich in natural resources collect severance taxes on oil and natural gas extraction, while Delaware trains its tax eye on corporations. Most stick to more typical personal income and sales taxes.

Nearly every state employs progressive ways of taxing the rich more than the poor, although several use flat-rate income taxes that take a much bigger relative bite out of low incomes than of big salaries. And in many states, sales taxes, the most regressive levy of all, comprise the biggest source of public revenue.

The size of tax revenues range from the enormous $188 billion collected last year by the state of California to the far more modest $1.78 billion pocketed by the state of Alaska. People everywhere love to complain about the taxes they pay, but a survey released April 2020 found 48% of people thought the amount of taxes they paid were about right, more than the 46% who thought their taxes were too high. Another 3% thought the taxes they paid were too low.

Check out the list to see what kinds of tax dollars your state collects, and how it compares with the rest of the country.

Alabama: Personal income tax

Tax source breakdown:

- Personal income tax: 36.2%

- General sales tax: 25.2%

- Selective sales tax: 23.4%

- Licenses tax: 4.8%

- Corporate tax: 5.9%

- Severance tax: 0.5%

- Property tax: 3.7%

- Other taxes: 0.4%

Personal income taxes in Alabama are relatively low, topping out at 5% of taxable income over $6,000 for married couples and over $3,000 for individuals. Its state sales tax also is low, at 4%.

Alaska: Severance tax

Tax source breakdown:

- Personal income tax: 0%

- General sales tax: 0%

- Selective sales tax: 15.7%

- Licenses tax: 9%

- Corporate tax: 18.7%

- Severance tax: 49.9%

- Property tax: 6.8%

- Other taxes: 0%

Half of Alaska’s tax revenues are severance taxes, levied on extraction of its natural resources of oil and natural gas. Those revenues allow the state to have neither a personal income tax nor a general sales tax. It also does not tax Social Security retirement benefits or pension payments, and it has no estate or inheritance taxes.

Arizona: General sales tax

Tax source breakdown:

- Personal income tax: 29.5%

- General sales tax: 46%

- Selective sales tax: 11.5%

- Licenses tax: 3.2%

- Corporate tax: 2.8%

- Severance tax: 0.1%

- Property tax: 6%

- Other taxes: 0.9%

Arizona voters approved a new tax in 2020 to hire, train, and pay school teachers, school nurses, counselors, and other educators. It added a 3.5% income tax surcharge on individual personal income over $250,000. The measure is estimated to generate between $825 million and $900 million a year for public schools.

Arkansas: General sales tax

Tax source breakdown:

- Personal income tax: 29.5%

- General sales tax: 35%

- Selective sales tax: 13.2%

- Licenses tax: 4%

- Corporate tax: 5.2%

- Severance tax: 0.6%

- Property tax: 11.8%

- Other taxes: 0.8%

Arkansas’ sales tax rates are the third-highest in the country, averaging 9.43%. But its average effective property taxes are the 10th-lowest nationwide. Sales and use tax revenues in Arkansas were up more than 10% year-over-year and nearly 13% above forecasts in the first two months of its fiscal year that started in July 2020, an indication of active consumer spending.

California: Personal income tax

Tax source breakdown:

- Personal income tax: 53.2%

- General sales tax: 22.1%

- Selective sales tax: 9.9%

- Licenses tax: 5.9%

- Corporate tax: 7.3%

- Severance tax: 0.1%

- Property tax: 1.6%

- Other taxes: 0%

California’s graduated income tax rates reach as high as 13.3% on top earners, the highest in the nation. The rate only kicks in, however, on those making more than $1 million a year. The state’s personal income, corporation, and sales tax revenue collections in September 2020 surpassed projections, after weakness over the summer tied to the economic impacts of the coronavirus. Officials linked the rebound in income tax payments to higher stock market prices and linked the corporate tax revenues to businesses revising expectations for profitability upward.

Colorado: Personal income tax

Tax source breakdown:

- Personal income tax: 51.5%

- General sales tax: 21.3%

- Selective sales tax: 16.5%

- Licenses tax: 4.4%

- Corporate tax: 5%

- Severance tax: 1.4%

- Property tax: 0%

- Other taxes: 0%

Colorado gets more than half its tax revenues from individual income taxes. Voters in the Nov 2020 election opted to cut the flat income tax rate to 4.55% from 4.63%, which will cut revenue by some $154 million in the 2021-2022 budget year. Opponents said the tax cut will worsen a budget deficit already estimated at $1.6 billion due to the coronavirus pandemic.

Connecticut: Personal income tax

Tax source breakdown:

- Personal income tax: 47%

- General sales tax: 25.5%

- Selective sales tax: 17.8%

- Licenses tax: 2.3%

- Corporate tax: 5%

- Severance tax: 0%

- Property tax: 0%

- Other taxes: 2.4%

Connecticut’s effective property tax rates are the second-highest in the country. The state has seven personal income tax brackets, ranging from 3% to 6.99%, with the highest rate kicking in on individual income above $500,000.

Delaware: Licenses tax

Tax source breakdown:

- Personal income tax: 37.9%

- General sales tax: 0%

- Selective sales tax: 13.1%

- Licenses tax: 38.8%

- Corporate tax: 6.3%

- Severance tax: 0%

- Property tax: 0%

- Other taxes: 3.9%

Taxes on corporate licenses typically do not comprise large shares of state revenue, but in Delaware, they amount to more than a third of the money going into state coffers. That means other tax rates are lower. Delaware does not tax Social Security benefits, and its income tax ceiling is 6.6% on income of more than $60,000. It also does not have a sales tax.

Florida: General sales tax

Tax source breakdown:

- Personal income tax: 0%

- General sales tax: 62.5%

- Selective sales tax: 18.9%

- Licenses tax: 4.7%

- Corporate tax: 7%

- Severance tax: 0.1%

- Property tax: 0%

- Other taxes: 6.8%

Florida gets more of its revenue from general sales taxes than almost any other state, and it’s one of just a handful of states that does not have a personal income tax. Counties can add discretionary taxes of their own up to 2.5%, and in the November 2020 election, several counties tacked on additional sales taxes to help fund their public school systems.

Georgia: Personal income tax

Tax source breakdown:

- Personal income tax: 49.3%

- General sales tax: 25.3%

- Selective sales tax: 13.2%

- Licenses tax: 2.9%

- Corporate tax: 5.1%

- Severance tax: 0%

- Property tax: 3.5%

- Other taxes: 0.7%

Georgia is one of only two states, along with North Carolina, that has a cap on its personal income tax. Voters approved its 6% percent cap in 2014. Its income tax rates range from 1% to 5.75%.

Hawaii: General sales tax

Tax source breakdown:

- Personal income tax: 31.3%

- General sales tax: 46.4%

- Selective sales tax: 15.3%

- Licenses tax: 3.4%

- Corporate tax: 2.3%

- Severance tax: 0%

- Property tax: 0%

- Other taxes: 1.3%

More than half of Hawaii’s tax revenues come from general and selective sales taxes. The state does not have a sales tax per se; rather it levies a General Excise Tax, or GET, on businesses that in turn commonly charge it to customers. GET revenues were about 25% less n the second quarter of 2020 than the same quarter of 2019, after the islands’ critical tourism industry came to a screeching halt due to the coronavirus.

Idaho: General sales tax

Tax source breakdown:

- Personal income tax: 34.2%

- General sales tax: 39.1%

- Selective sales tax: 12.8%

- Licenses tax: 7.9%

- Corporate tax: 5.8%

- Severance tax: 0.1%

- Property tax: 0%

- Other taxes: 0.1%

Idaho’s sales tax rate is lower than the national average at 6%, with limited local additions. The top rate in its progressive income tax system is 6.925%, the 15th-highest among U.S. states. The state lowered its top rate on high earners in 2011. Property taxes, meanwhile, are 15th-lowest among U.S. states.

Illinois: Personal income tax

Tax source breakdown:

- Personal income tax: 38.9%

- General sales tax: 28.3%

- Selective sales tax: 17.7%

- Licenses tax: 6.5%

- Corporate tax: 7.3%

- Severance tax: 0%

- Property tax: 0.1%

- Other taxes: 1.2%

Voters in Illinois defeated a proposal in the November 2020 election that would have abolished the state’s flat-rate income tax for one that was progressive. Advocates said it would have lowered or kept taxes the same for 97% of residents and raised taxes of those making $250,000 or more. The flat-rate income tax is 4.95%. The progressive tax alternative would have topped out at 7.99%. Opponents argued that the revenue would not be used to pay down debt, but to fund new programs, and that it would pave the way for more taxation. Some said wealthy residents would leave the state.

Indiana: General sales tax

Tax source breakdown:

- Personal income tax: 30%

- General sales tax: 40.1%

- Selective sales tax: 22.3%

- Licenses tax: 3.8%

- Corporate tax: 3.7%

- Severance tax: 0%

- Property tax: 0.1%

- Other taxes: 0%

Indiana’s personal income tax is a flat rate of 3.23%, but many of its counties charge their own income taxes as well, bringing the total as high as 6.5%. The state sales tax rate is 7%, and unlike the income tax, municipalities do not tack on local levies.

Iowa: Personal income tax

Tax source breakdown:

- Personal income tax: 38.7%

- General sales tax: 32.2%

- Selective sales tax: 13.7%

- Licenses tax: 9.4%

- Corporate tax: 5.1%

- Severance tax: 0%

- Property tax: 0%

- Other taxes: 0.9%

Iowa’s progressive income rates stretch from one of the nation’s lowest—0.33%—to one of the highest—8.53%. The state’s sales taxes are in line with the national average, but its effective property taxes are high compared with other U.S. states. Iowa’s state income revenues dropped in 2020 due to the impacts of the coronavirus pandemic, but were offset by taxes levied on unemployment benefits paid out to idled workers.

Kansas: Personal income tax

Tax source breakdown:

- Personal income tax: 37.7%

- General sales tax: 33.3%

- Selective sales tax: 11.9%

- Licenses tax: 4.3%

- Corporate tax: 4.9%

- Severance tax: 0.6%

- Property tax: 7.5%

- Other taxes: 0%

The highest personal income tax bracket in Kansas is 5.7%, levied on individual taxable income of $30,000 or more. But the average sales tax rate is the country’s eighth-highest. Kansas’ sales tax rate is 6.5%, while with local levies around the state, it can reach as high as 10.5%.

Kentucky: Personal income tax

Tax source breakdown:

- Personal income tax: 35.9%

- General sales tax: 30.9%

- Selective sales tax: 18%

- Licenses tax: 4.1%

- Corporate tax: 4.5%

- Severance tax: 1.2%

- Property tax: 5%

- Other taxes: 0.4%

Kentucky’s tax revenues were recovering in late summer, up from year-over-year collections in 2019, providing funding for education, public safety, and health care. But the pickup followed months of much lower tax revenues due to the coronavirus pandemic, officials said. Severance tax revenues on coal extraction were off more than 30% from the same period in 2019.

Louisiana: Personal income tax

Tax source breakdown:

- Personal income tax: 32.6%

- General sales tax: 31.8%

- Selective sales tax: 22.7%

- Licenses tax: 3.7%

- Corporate tax: 4.2%

- Severance tax: 4.3%

- Property tax: 0.7%

- Other taxes: 0.

Louisiana’s personal income tax rates range from 2% to 6%, but its average sales taxes are among the highest in the nation. The state’s sales tax rate is 4%, but counties and cities can add local sales tax of up to 7%, putting the top sales tax at 11%. Louisiana has 667 jurisdictions that can levy their own sales taxes. The average, however, is 8.91% statewide.

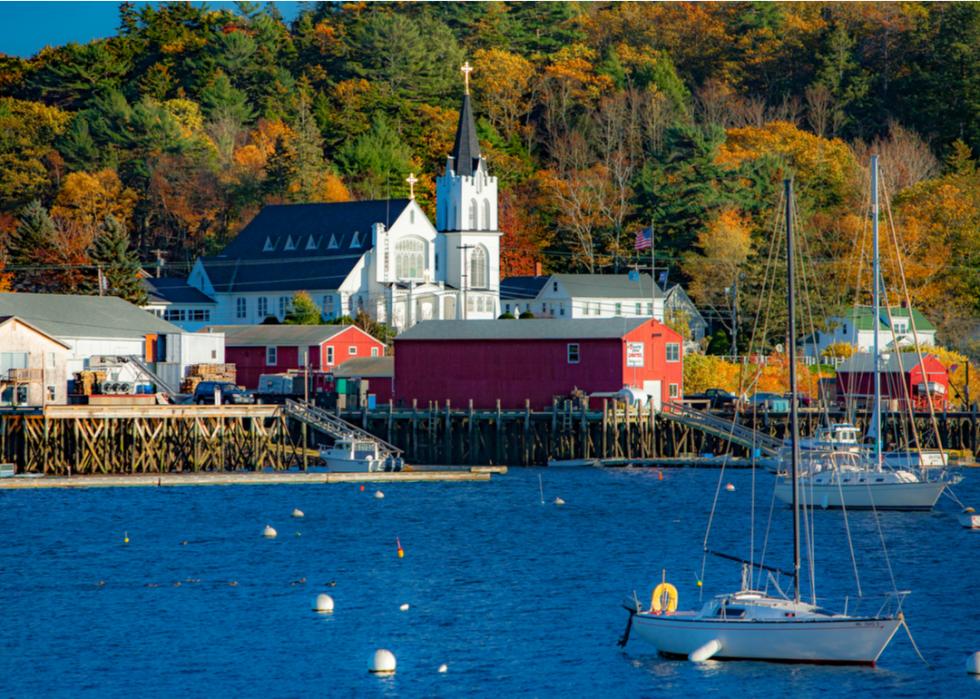

Maine: Personal income tax

Tax source breakdown:

- Personal income tax: 36.6%

- General sales tax: 34.5%

- Selective sales tax: 15.3%

- Licenses tax: 6.2%

- Corporate tax: 5.4%

- Severance tax: 0%

- Property tax: 0.9%

- Other taxes: 1.1%

Maine’s tax revenues were hard-hit by the impact of the coronavirus on local business, particularly tourism. It is looking at a projected $1.4 billion revenue shortfall over the next three budget years. The governor has vowed to battle any double-taxation on residents who work for companies out of state, particularly Massachusetts which is imposing income taxes on employees who are working from home in Maine.

Maryland: Personal income tax

Tax source breakdown:

- Personal income tax: 42.7%

- General sales tax: 20.7%

- Selective sales tax: 21.2%

- Licenses tax: 3.9%

- Corporate tax: 5.5%

- Severance tax: 0%

- Property tax: 3.5%

- Other taxes: 2.5%

Maryland lawmakers have been looking to expand its menu of tax revenue sources. In the 2020 session, the legislature approved excise tax increases on tobacco and vaping products that were vetoed by the governor, but are likely to be brought up again. Lawmakers also looked at proposals to legalize and tax sports betting. Critics caution that such specific excise tax streams can be unreliable and volatile.

Massachusetts: Personal income tax

Tax source breakdown:

- Personal income tax: 53.9%

- General sales tax: 21.5%

- Selective sales tax: 8.6%

- Licenses tax: 3.8%

- Corporate tax: 9.3%

- Severance tax: 0%

- Property tax: 0%

- Other taxes: 3%

Massachusetts has a flat income tax rate of 5.05%, one of just nine states with a flat rate, and it has a flat statewide sales tax rate of 6.25% as well. The state got embroiled in a legal dispute with neighboring New Hampshire during the coronavirus pandemic for collecting income tax from about 80,000 New Hampshire residents employed by Massachusetts companies, but working from home.

Michigan: Personal income tax

Tax source breakdown:

- Personal income tax: 33.5%

- General sales tax: 31.8%

- Selective sales tax: 15.6%

- Licenses tax: 6.7%

- Corporate tax: 3.8%

- Severance tax: 0.1%

- Property tax: 7.3%

- Other taxes: 1.3%

A quarter of Michigan’s income tax revenues goes to schools, and $600 million next year is dedicated to state transportation. Other major allocations go to Medicaid and to state universities. Looking back to the 2007-2008 recession, Michigan’s income tax revenues took a 16% tumble.

Minnesota: Personal income tax

Tax source breakdown:

- Personal income tax: 44%

- General sales tax: 22%

- Selective sales tax: 17.6%

- Licenses tax: 5.3%

- Corporate tax: 6.1%

- Severance tax: 0.2%

- Property tax: 2.9%

- Other taxes: 1.9%

The four personal income tax rate brackets in Minnesota range from 5.35% to 9.85%, which kicks in on individual taxable income above about $162,000. The rates rank among the nation’s highest. Property and sales taxes also are higher than the national averages, each one putting Minnesota in the top 20 most tax-costly states. In several cities, sales taxes top 7.5%, and downtown Minnesota adds a 3% surtax on entertainment, restaurants, and liquor sales.

Mississippi: General sales tax

Tax source breakdown:

- Personal income tax: 23.8%

- General sales tax: 45%

- Selective sales tax: 18.1%

- Licenses tax: 6.2%

- Corporate tax: 6%

- Severance tax: 0.6%

- Property tax: 0.3%

- Other taxes: 0%

Mississippi’s reliance on sales tax revenue has proven problematic this year with coronavirus-related declines in tourist visitors, retail sales, and fuel purchases, according to officials. The mayor of Vicksburg, Mississippi, said during the summer of 2020 that the city’s $30 million budget had lost more than $3.2 million in tourism revenue in the second quarter from a lack of visitors and little demand for hotel space.

Missouri: Personal income tax

Tax source breakdown:

- Personal income tax: 50%

- General sales tax: 28.3%

- Selective sales tax: 13.8%

- Licenses tax: 4.8%

- Corporate tax: 2.8%

- Severance tax: 0%

- Property tax: 0.3%

- Other taxes: 0.1%

Missouri’s tax revenues dropped 29% from March to May this year compared with last, due to the coronavirus outbreak. The shortfall led to more than $448 million being withheld from the fiscal 2021 budget which took effect on July 1, cutting into education funding most. Missouri’s sales taxes are a bit higher than the national average, while property taxes are a bit lower.

Montana: Personal income tax

Tax source breakdown:

- Personal income tax: 44.6%

- General sales tax: 0%

- Selective sales tax: 20.9%

- Licenses tax: 12.3%

- Corporate tax: 5.8%

- Severance tax: 6.4%

- Property tax: 9.9%

- Other taxes: 0.1%

Montana has an income tax that is progressive, with a maximum rate of 6.9%, and no general sales tax. It levies a selective sales tax on rental cars, hotel rooms, and campgrounds, and small communities that qualify as resort towns can tax tourist goods and luxury items. The state’s property taxes are generally low.

Nebraska: Personal income tax

Tax source breakdown:

- Personal income tax: 44.2%

- General sales tax: 34.2%

- Selective sales tax: 10.7%

- Licenses tax: 3.2%

- Corporate tax: 7.4%

- Severance tax: 0.1%

- Property tax: 0%

- Other taxes: 0.3%

Personal income tax rates in Nebraska range from 2.46% to 6.84%, following across-the-board cuts and adjustments made in 2012. Its average effective property rate, however, is one of the nation’s highest. Per capita, property tax collections are 12th highest in the country, and 8th highest when measured as a percentage of total home value.

Nevada: General sales tax

Tax source breakdown:

- Personal income tax: 0%

- General sales tax: 56.5%

- Selective sales tax: 24%

- Licenses tax: 7.2%

- Corporate tax: 0%

- Severance tax: 1.3%

- Property tax: 3.4%

- Other taxes: 7.7%

Nevada relies on its sales taxes for more than half its revenue. But with tourism coming to a near halt due to the coronavirus, its sales tax revenues dried up. Lawmakers held a special session to pass deep budget cuts to address a shortfall of some $1.2 billion.

New Hampshire: Selective sales tax

Tax source breakdown:

- Personal income tax: 4.1%

- General sales tax: 0%

- Selective sales tax: 33.5%

- Licenses tax: 15.7%

- Corporate tax: 28%

- Severance tax: 0%

- Property tax: 13.8%

- Other taxes: 5%

New Hampshire does not have a general sales tax, but instead has a selective tax that targets tourism. It levies taxes on restaurant meals, hotel rooms, and car rentals. The state has no income tax on wages and salaries, but does tax investment income like dividends and interest. It also has relatively high property taxes.

New Jersey: Personal income tax

Tax source breakdown:

- Personal income tax: 40.9%

- General sales tax: 27.9%

- Selective sales tax: 13.4%

- Licenses tax: 4.4%

- Corporate tax: 10.4%

- Severance tax: 0%

- Property tax: 0%

- Other taxes: 2.9%

State lawmakers and the governor of New Jersey agreed in September to raise the income tax rate on personal income ranging from $1 million to $5 million to 10.75% from 8.97%. Previously, the 10.75% rate applied to income over $5 million. The increase was designed to address declining sales tax revenues and the cost of paying unemployment payments to workers left jobless in the coronavirus pandemic.

New Mexico: General sales tax

Tax source breakdown:

- Personal income tax: 21.4%

- General sales tax: 38.6%

- Selective sales tax: 11.1%

- Licenses tax: 4.5%

- Corporate tax: 2.7%

- Severance tax: 20.1%

- Property tax: 1.2%

- Other taxes: 0.5%

New Mexico’s state sales tax rate is 5.125%, but with added levies by local municipalities can reach as high as 9.0625%. State officials say sales tax revenues have been particularly impacted by a decline in the restaurant, arts, and entertainment industries due to the coronavirus pandemic.

New York: Personal income tax

Tax source breakdown:

- Personal income tax: 59.3%

- General sales tax: 16.8%

- Selective sales tax: 12.9%

- Licenses tax: 2%

- Corporate tax: 4.7%

- Severance tax: 0%

- Property tax: 0%

- Other taxes: 4.3%

New York state collected $48 billion in personal income tax revenue in the fiscal year 2018-2019. Some lawmakers have proposed raising taxes on wealthy earners to help address a budget shortfall estimated at $14.5 billion in the current fiscal year due to the pandemic. But Gov. Andrew Cuomo has pushed back, arguing that such a tax could put the state at a disadvantage and entice people who left during the height of the outbreak not to return.

North Carolina: Personal income tax

Tax source breakdown:

- Personal income tax: 45.2%

- General sales tax: 28.9%

- Selective sales tax: 14.8%

- Licenses tax: 7.9%

- Corporate tax: 2.9%

- Severance tax: 0%

- Property tax: 0%

- Other taxes: 0.3%

North Carolina has had a flat income tax rate of 5.25% since its 2013 tax reform. In 2018, voters backed an amendment to the constitution to cap the maximum allowable income tax rate at 7%, down from 10%. Historically, the rate has gone as high as 8.25%. The state’s property taxes on average are lower than the national average.

North Dakota: Severance tax

Tax source breakdown:

- Personal income tax: 8.4%

- General sales tax: 21.2%

- Selective sales tax: 10.3%

- Licenses tax: 4.6%

- Corporate tax: 3%

- Severance tax: 52.5%

- Property tax: 0.1%

- Other taxes: 0%

More than half of North Dakota’s public revenues are severance taxes, thanks to the state’s assets of oil and natural gas. Severance taxes can be volatile, subject to commodity market changes in price and demand, and states that rely on them may need flexible budgeting procedures and significant rainy day funds.

Ohio: General sales tax

Tax source breakdown:

- Personal income tax: 30.9%

- General sales tax: 42.1%

- Selective sales tax: 19.4%

- Licenses tax: 7.4%

- Corporate tax: 0%

- Severance tax: 0.2%

- Property tax: 0%

- Other taxes: 0%

In Ohio, sales tax revenue on items such as clothing, vehicle sales, and restaurant dining could drop by half due to the pandemic, according to new Ohio State University research, taking significant tolls on the budgets in small cities and towns. The state has more than 1,300 municipalities. Ohio ended fiscal 2020 at the end of June with tax revenues off 4.6% from estimates, a consequence of restrictions due to the coronavirus pandemic.

Oklahoma: Personal income tax

Tax source breakdown:

- Personal income tax: 33.2%

- General sales tax: 28.6%

- Selective sales tax: 14.7%

- Licenses tax: 9.7%

- Corporate tax: 2.8%

- Severance tax: 10.8%

- Property tax: 0%

- Other taxes: 0.2%

Oklahoma’s personal income tax rates are progressive, starting as low as .5% and topping out at 5%. The state’s gross tax receipts have been trending downward in recent months, according to state treasury officials, with a decline in sales revenues and in oil and gas production taxes due to a drop in energy prices.

Oregon: Personal income tax

Tax source breakdown:

- Personal income tax: 70.5%

- General sales tax: 0%

- Selective sales tax: 13.4%

- Licenses tax: 8.1%

- Corporate tax: 6.5%

- Severance tax: 0.1%

- Property tax: 0.2%

- Other taxes: 1.2%

Oregon is one of the few states with no general sales tax, although it selectively levies a 1% tax on camping sites, hotel and motel rooms, and other tourist lodging. The bulk of state revenues comes from a personal income tax, which ranges from 5% to 9.9%. A 9% rate applies to couples filing with as little as $17,000 or as much as $250,000 in taxable income.

Pennsylvania: Personal income tax

Tax source breakdown:

- Personal income tax: 31.3%

- General sales tax: 27.2%

- Selective sales tax: 24.1%

- Licenses tax: 6.4%

- Corporate tax: 6.9%

- Severance tax: 0%

- Property tax: 0.1%

- Other taxes: 4%

In its October tax collections, Pennsylvania brought in $1 billion in personal income tax revenue, more than $123 million higher than projected estimates. Officials also reported higher than anticipated sales tax and corporate tax revenues, saying the numbers indicated an economy that was bouncing back from the impacts of the coronavirus, but with a long way to go before recovering revenue lost earlier in the year.

Rhode Island: Personal income tax

Tax source breakdown:

- Personal income tax: 37%

- General sales tax: 30.1%

- Selective sales tax: 19.1%

- Licenses tax: 3.1%

- Corporate tax: 4.7%

- Severance tax: 0%

- Property tax: 0.1%

- Other taxes: 6%

Rhode Island’s highest income tax bracket is a rate of 5.99%, levied on taxable income of $145,600 or more. On average, the state’s property tax rates are steep, ranking 10th-highest among the 50 states.

South Carolina: Personal income tax

Tax source breakdown:

- Personal income tax: 42.4%

- General sales tax: 30.9%

- Selective sales tax: 15.8%

- Licenses tax: 5.8%

- Corporate tax: 3.5%

- Severance tax: 0%

- Property tax: 0.4%

- Other taxes: 1.2%

The state sales tax in South Carolina is 6%, although its counties can impose another 1% sales tax with voter approval. Of the state’s 46 counties, 32 have local option sales taxes. In the November 2020 election, Charleston County voters opted to extend its penny sales tax, which had been set to expire in 2022. Much of the money goes to school maintenance and improvements, and in past years, 40% of the penny sale tax was paid by the seven million tourists who typically visit Charleston each year.

South Dakota: General sales tax

Tax source breakdown:

- Personal income tax: 0%

- General sales tax: 59%

- Selective sales tax: 24.2%

- Licenses tax: 14.1%

- Corporate tax: 2.4%

- Severance tax: 0.3%

- Property tax: 0%

- Other taxes: 0%

South Dakota is one of seven states that do not tax personal income. While its sales tax comprises most of the state’s revenues, the rate is relatively low at 4.5%. Adding to that, localities can impose general municipal sales taxes as high as 2% as well as a 1% municipal gross receipts tax on lodging, alcoholic beverages, restaurants, and amusement, cultural, and athletic events.

Tennessee: General sales tax

Tax source breakdown:

- Personal income tax: 1.4%

- General sales tax: 52.9%

- Selective sales tax: 19.5%

- Licenses tax: 12.9%

- Corporate tax: 11.5%

- Severance tax: 0%

- Property tax: 0%

- Other taxes: 1.9%

General sales taxes provide more revenue to Tennessee than they do in nearly any other state. Its statewide sales tax rate is 7%, and its 241 local jurisdictions can apply their own taxes of up to 2.75%. On average, that puts the state’s overall sales tax at 9.53%, the highest of the 50 states.

Texas: General sales tax

Tax source breakdown:

- Personal income tax: 0%

- General sales tax: 60.2%

- Selective sales tax: 24.9%

- Licenses tax: 5.8%

- Corporate tax: 0%

- Severance tax: 9.1%

- Property tax: 0%

- Other taxes: 0%

General and selective sales taxes fill Texas’ public coffers with about three quarters of their funds. In September of 2020, Texas collected about $2.6 billion in sales taxes, off more than 6% from the previous year due to the coronavirus pandemic and the low price of crude oil. The state collected $78 million in taxes on alcoholic beverages, down a third from a year earlier, and hotel occupancy taxes were off more than a third as well.

Utah: Personal income tax

Tax source breakdown:

- Personal income tax: 50%

- General sales tax: 28.4%

- Selective sales tax: 12.3%

- Licenses tax: 3.6%

- Corporate tax: 5.2%

- Severance tax: 0.5%

- Property tax: 0%

- Other taxes: 0%

Utah’s income tax rate is a flat 4.95%. Its sales taxes, with a state rate is 4.85%, range from 6.1% to 9.05% depending on locally added levies. Property taxes, which are paid to individual counties, on average are among the lowest in the nation.

Vermont: Property tax

Tax source breakdown:

- Personal income tax: 25.1%

- General sales tax: 12%

- Selective sales tax: 20.7%

- Licenses tax: 3.7%

- Corporate tax: 4.4%

- Severance tax: 0%

- Property tax: 32.4%

- Other taxes: 1.7%

Vermont residents pay some of the highest property taxes in the country. That’s largely because the state levies a property tax as do local governments. The state property tax is used to fund education.

Virginia: Personal income tax

Tax source breakdown:

- Personal income tax: 56.6%

- General sales tax: 20.8%

- Selective sales tax: 11.9%

- Licenses tax: 3.4%

- Corporate tax: 3.5%

- Severance tax: 0%

- Property tax: 0.1%

- Other taxes: 3.7%

Virginia hauls in more than half its state revenues from personal income taxes, employing a progressive scale from 2% to 5.75%, which is slightly below the national average. Its average state and local sales taxes are the 10th-lowest among U.S. states.

Washington: General sales tax

Tax source breakdown:

- Personal income tax: 0%

- General sales tax: 59.5%

- Selective sales tax: 16.9%

- Licenses tax: 6.2%

- Corporate tax: 0%

- Severance tax: 0.2%

- Property tax: 12%

- Other taxes: 5.2%

Washington took in more of its tax revenues in the form of a general sales tax than any other state in 2017. Its statewide sales tax rate is 6.65%, and localities can add a 1% tax of their own. A new measure effective this year also allows counties and cities to impose a 0.1% tax for building or operating affordable housing.

West Virginia: Personal income tax

Tax source breakdown:

- Personal income tax: 35.3%

- General sales tax: 25.2%

- Selective sales tax: 24%

- Licenses tax: 4.1%

- Corporate tax: 3.4%

- Severance tax: 7.8%

- Property tax: 0.1%

- Other taxes: 0.2%

While West Virginia relies on personal income taxes for the bulk of its public money, falling revenues from its severance taxes on coal and natural gas have taken a fiscal toll. In August 2020, the state reaped $3.9 million in severance tax revenues, a third less than projected estimates and 87% below revenues a year earlier.

Wisconsin: Personal income tax

Tax source breakdown:

- Personal income tax: 43.7%

- General sales tax: 28.4%

- Selective sales tax: 13.7%

- Licenses tax: 6.3%

- Corporate tax: 6.8%

- Severance tax: 0.1%

- Property tax: 0.5%

- Other taxes: 0.5%

Wisconsin’s marginal income tax rate for residents tops out at 7.65%. That puts it fairly in the middle between states with high income tax rates like California and low rates like Tennessee. More than $256 million in tax relief will be used to lower state income tax rates, following a 2019 law that requires out-of-state retailers, like Amazon, to pay Wisconsin sales taxes. State officials said the relief is especially welcome as the state grapples with the costs of the coronavirus. It collected more than $8 billion in individual income taxes in fiscal 2020, which was more than $146 million less than had been anticipated.

Wyoming: General sales tax

Tax source breakdown:

- Personal income tax: 0%

- General sales tax: 36.5%

- Selective sales tax: 8.7%

- Licenses tax: 9.9%

- Corporate tax: 0%

- Severance tax: 31.7%

- Property tax: 13%

- Other taxes: 0.3%

Even though Wyoming is rich in natural gas and oil, severance taxes on extraction rank second in terms of tax revenues after its sale taxes. Voters in the November 2020 election approved a handful of local tax hikes, including a 1% sales tax in Sheridan County for municipal and county projects, but rejected 1% sales taxes in Park and Teton counties. Several counties voted to extend hotel lodging taxes, earmarking the revenue for tourism promotion and services.