The most expensive states to own a car

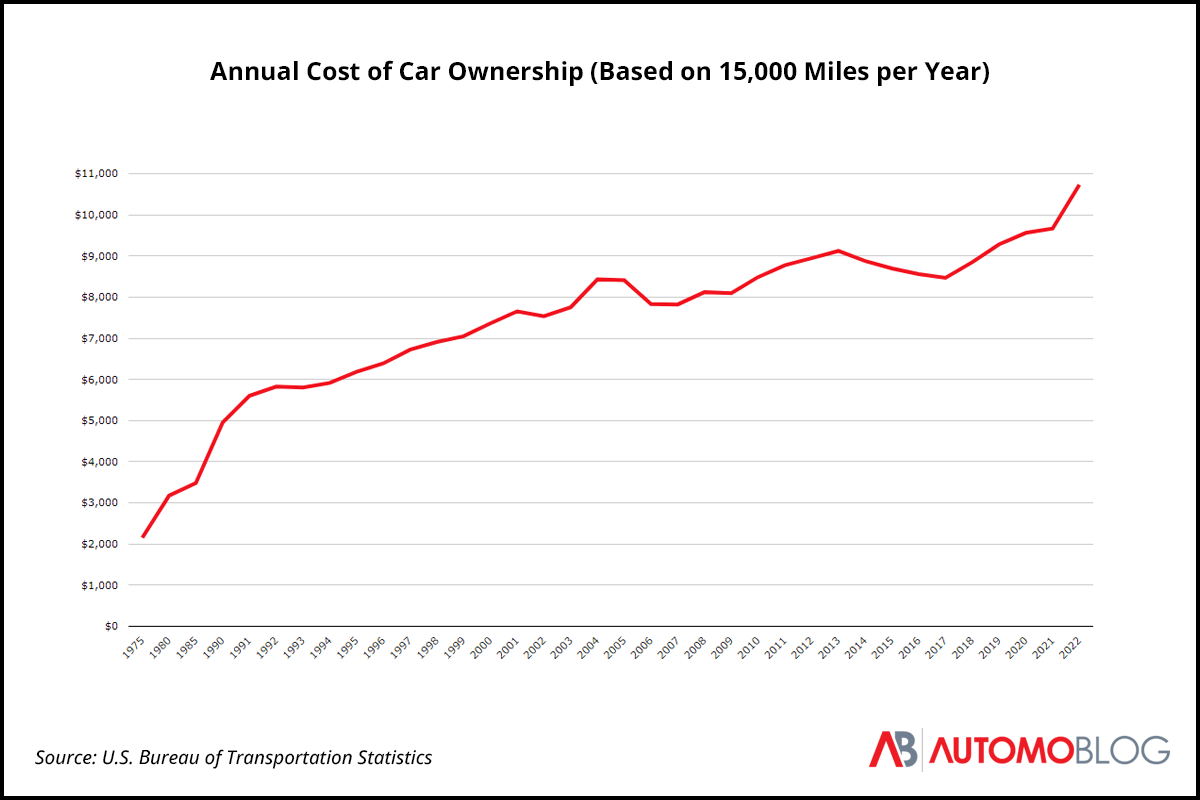

No matter where you live in the U.S., owning a car costs a lot of money. And studies suggest it's continuing to get more expensive each year. Automobolog analyzed data from the Bureau of Transportation Statistics to find that the annual cost of owning a car topped $10,000 for the first time in 2022. The most recent annual estimate of $10,729 per year represents a 19.9% increase over the last decade.

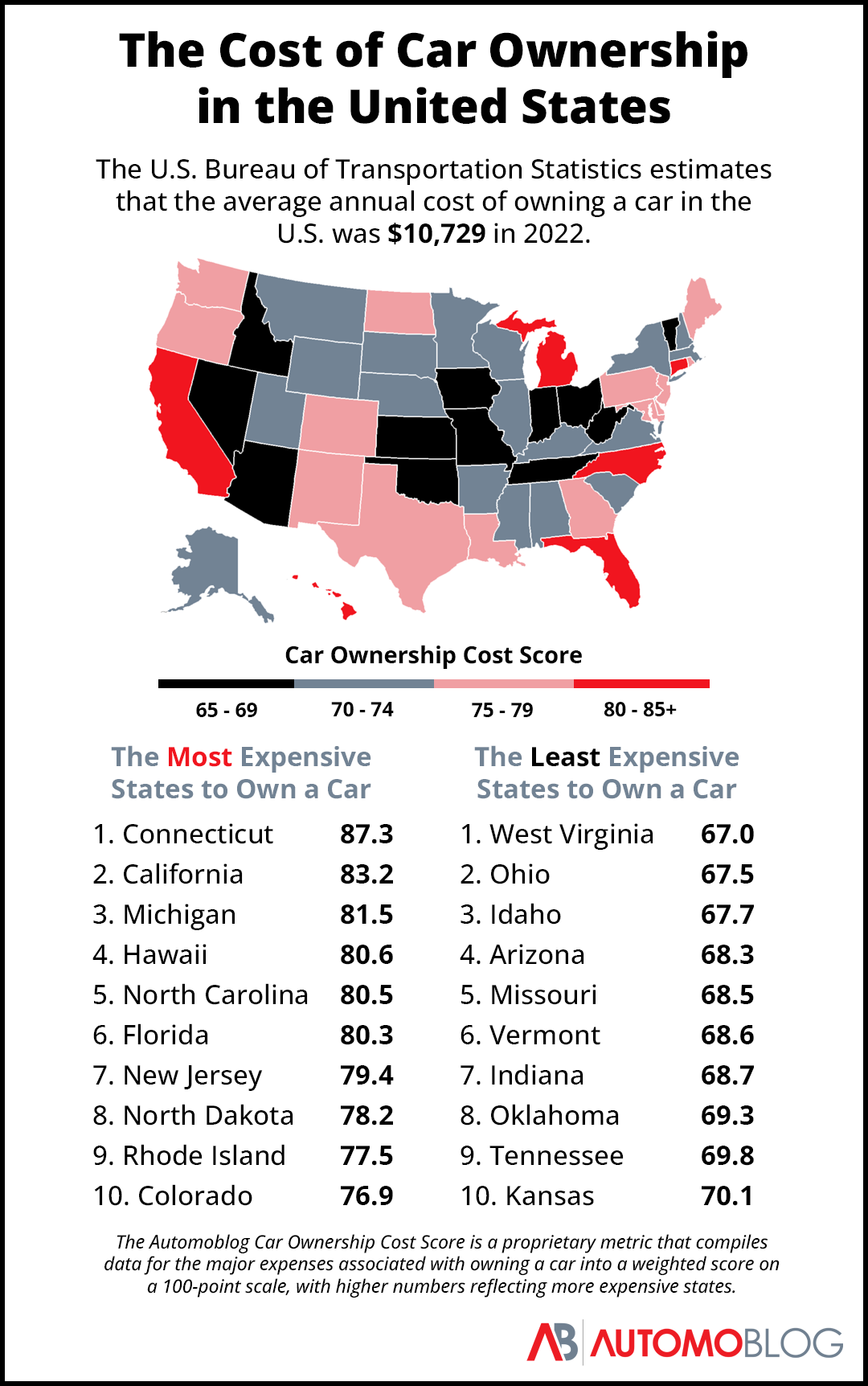

However, many of the costs associated with owning a car vary by location. As a result, car ownership in some states is more expensive than in others. To find out which are the most expensive states to own a car, we conducted a state-by-state study of the average costs of major automobile expenses. We then took those study results to reveal the states where drivers pay the most to own a car.

10 states with the highest cost of car ownership

The study utilized data reflecting the major costs of owning a car for each state and crunched the numbers to create a Car Ownership Cost Score. This proprietary score is based on a 100-point scale, with the most expensive states to own a car earning the highest numbers. Researchers found that Connecticut is the most expensive state for car owners, with a score of 87.3.

In the section below, you'll find a breakdown of the cost scores for Connecticut and the rest of the 10 most expensive states to own a car. We've also provided more detailed information about individual costs.

#1 Connecticut: 87.3

Insurance: 91.3

Property Tax: 94.1

Auto Repair: 93.0

Gas: 72.9

Connecticut drivers pay more to own a car than drivers in any other state. The state isn't ranked first in any single cost category, but its consistent position near the top in almost every one results in an overall expensive car ownership experience.

For example, the 2.15% Connecticut car owners pay in property taxes each year is 99.1% higher than the national average and the third-highest rate in the country. Car insurance in Connecticut is also among the priciest. Drivers in the Constitution State pay an average of $1,503 per year just for a minimum coverage policy and a whopping $2,999 per year for full coverage.

#2 California: 83.2

Insurance: 73.8

Property Tax: 68.4

Auto Repair: 100.0

Gas: 94.6

While insurance costs and auto property taxes for California car owners sit near the middle of the pack, drivers get hit hard when it comes to car repairs and gas costs. The Golden State is first in the country in auto repair costs, with the average cost of repairs 8.1% higher than the national average. It's also the second-most expensive state to fill up your tank.

#3 Michigan: 81.5

Insurance: 100.0

Property Tax: 81.8

Auto Repair: 64.8

Gas: 68.9

Car insurance is the main reason Michigan lands at number three on the list. Car owners in The Great Lakes State pay more than anyone else to insure their vehicles, with the average cost of a full coverage policy at an astonishing $3,785 per year. Property taxes are also higher in Michigan than in most states at 1.48%. These high rates are enough to offset the relatively affordable auto repair and gas costs in the state.

#4 Hawaii: 80.6

Insurance: 71.1

Property Tax: 60.0

Auto Repair: 93.7

Gas: 100.0

At just 0.29%, Hawaii has the lowest property tax rate in the country. But that's not enough to keep The Aloha State from ranking as the fourth most expensive state to own a car. Hawaii is the most expensive state to buy gasoline, where it costs 35.1% more to fuel up than the national average. Drivers also pay more than in most parts of the country to have their cars repaired, as Hawaii has the seventh-highest average repair cost in the nation.

#5 North Carolina: 80.5

Insurance: 78.2

Property Tax: 69.4

Auto Repair: 93.7

Gas: 82.1

While property taxes are lower than average in The Tar Heel State, costs are relatively high in every other category. At $1,015 per month for minimum coverage and $2,149 per month for full coverage, the average cost of car insurance in North Carolina is 34% higher than the average for the country. But it's the cost of gas and auto repairs that really gives North Carolina drivers the blues. Car owners pay 14.1% and 5.1% more than the national average for each, respectively.

Expensive states to own a car

#6 Florida: 80.3

Insurance: 89.2

Property Tax: 70.5

Auto Repair: 88.1

Gas: 69.3

Drivers in Florida enjoy relatively low property taxes and gas costs compared to the rest of the country. However, things get a little gloomy in The Sunshine State when it's time to pay for insurance coverage. Florida is the third most expensive state for car insurance, where the average policy costs a staggering 81.7% more than the national average. A minimum coverage policy costs $1,343 per year on average, while the average cost of a full coverage policy is $2,947. Gas costs are also on the higher side of average in Florida.

#7 New Jersey: 79.4

Insurance: 64.5

Property Tax: 100.0

Auto Repair: 94.0

Gas: 71.7

At 2.47%, New Jersey's property tax rate is the highest in the country and 128.7% higher than the national average. The Garden State is also the fifth most expensive state to get your car fixed, with the average cost of auto repairs 5.2% higher than average. With rates 23.4% below the national average, New Jersey is one of the more affordable states to insure your car. But that's still not enough to offset the high costs in other categories and keep New Jersey out of the top 10 most expensive states to own a car.

#8 North Dakota: 78.2

Insurance: 88.9

Property Tax: 73.0

Auto Repair: 68.3

Gas: 75.4

North Dakota is still an expensive place to be a car owner, despite having the seventh lowest average repair costs in the country. The state's high cost score is due, in part, to the price of fuel. North Dakota has the 10th highest average gas cost in the nation, with drivers paying 6.3% more than average to fill up. However, the main factor landing North Dakota on the list is the cost of auto insurance in Roughrider Country. Car owners pay an average of $1,472 for minimum coverage and $2,783 for full coverage in North Dakota, making the state the fourth most expensive place to buy an insurance policy.

#9 Rhode Island: 77.5

Insurance: 73.2

Property Tax: 82.8

Auto Repair: 85.2

Gas: 73.2

Nothing comes cheap for car owners in Rhode Island. Auto repair costs are essentially at the average for the country. But car owners pay 12.3% more than the national average for auto insurance and 3.8% more for gas. It's property taxes, however, that drive up the cost of car ownership in Little Rhody the most. The 1.53% property tax rate is 41.7% higher than the country's average rate and the 11th highest in the nation overall.

#10 Colorado: 76.9

Insurance: 71.0

Property Tax: 64.0

Auto Repair: 93.0

Gas: 82.5

While car owners in Colorado enjoy lower-than-average property taxes, they also face the fifth highest gas prices in the country. Adding to the tab is car insurance, which costs 3.1% more in The Centennial State than the average for the country. However, the mile-high cost of car repairs is what pushes the state into the final spot on the top 10. Drivers pay 4.7% more than the national average for auto repairs, making Colorado the ninth most expensive state to get your car fixed.

Methodology

The researchers compiled multiple cost data points for four categories of major car ownership expenses: auto insurance, taxes, auto repairs, and fuel. They averaged the costs for each category and then translated them to a 100-point scale proportional to the differences in costs to allow for easier comparison. Then, they weighted the categories based on their impact on car ownership costs to create a single cost data score for each state, also on a 100-point scale.

This story was produced by Automoblog and reviewed and distributed by Stacker Media.